What is the Average Buying Price of a stock?

Average Buying Price of a stock is “the total amount invested in the stock” divided by “the total number of shares purchased of the stock”.

Average Buying Price using Arithmetic mean

One way of calculating Average Buying Price is using the arithmetic mean. In a sense, Average Buying Price is the arithmetic mean of individual share’s price that you have bought over time.

Example 1

Say you have bought three shares of a company at prices:

You can say that you paid

2 for each of the three shares.

Example 2

Say you have bought five shares: three shares for

You have purchased five shares for

2.8 each.

Average Buying Price using Weighted Average

In practice, it is not easy to add up individual share prices. It can be simplified using a mathematical formulation called Weighted Average, which takes purchased quantity and the price (for which many shares are collected).

- p1 is the price at share unit

- q1 is the number of shares bought at price p1so on

In a grand sense, you reach back to the invested amount of a transaction by multiplying purchased units with unit price. Weighted Average helps you calculate the average price over multiple transactions.

In practice

Let’s understand Weighted Average formulation with an example:

Say you have bought five shares: three shares for

Significance of Average Buying Price

Average Buying Price acts as a reference for calculating your profit & loss. Selling or purchasing some shares requires calculating the new Average Price. Understanding how the new price is calculated helps in making well-informed decisions.

Extending example 2, let’s say you buy five additional shares for

You don’t need to add the individual share price to your calculation; instead, you can use the previously calculated average price, i.e.,

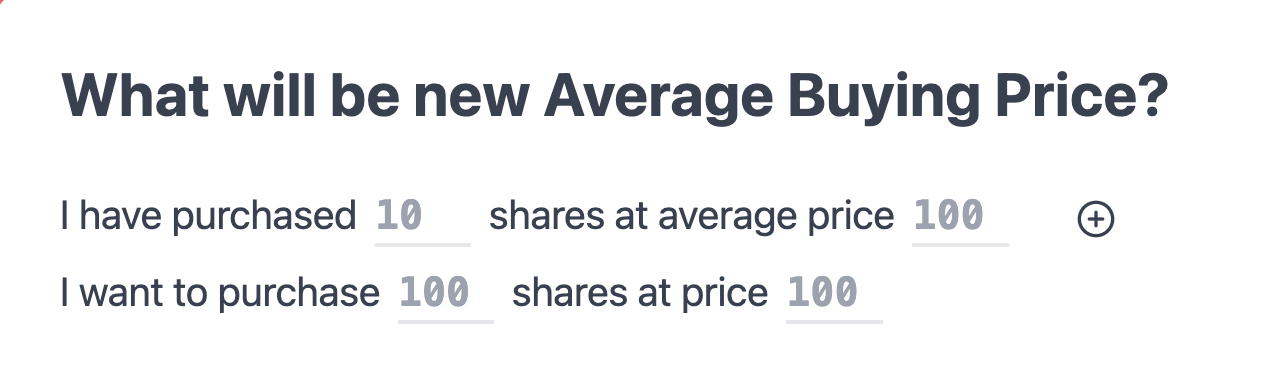

You don’t need to remember or apply the formula on your own; We have created a tool for you for such calculation.

Summary

In simple understanding, Average Buying price is the total amount invested divided by the total number of shares purchased. It acts as a reference price for communication and calculating profit & loss.

In real life, you don’t buy shares in a single transaction; you might need to estimate the “future buying average” before you invest more in the stock. So, understanding how average buying calculation works can save you from blunders.

Don't hesitate to contact us at @5cripo for any feedback or suggestions.